Will ETH Break Above $3,000 in September? –

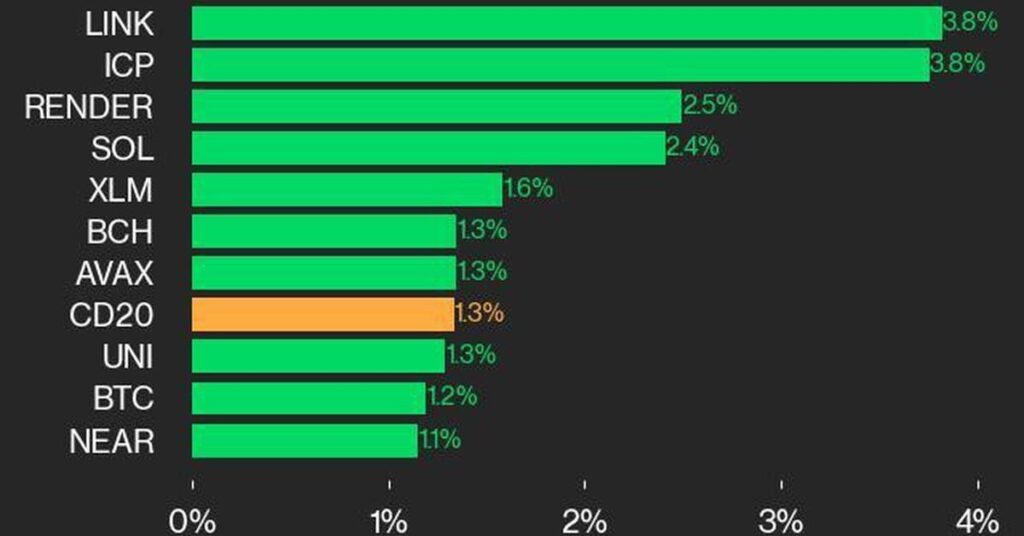

Image attributed to: newsBTC.com Welcome back to another exciting day in the world of Ethereum! If you’re wondering what the latest buzz is, you’re in the right place. Today, we’re diving deep into the latest Ethereum news today, where analysts are buzzing about the potential for ETH to soar above $3,000 as early as next month. Buckle up, because it looks like we’re in for a wild ride! First up, a shoutout to NewsBTC, where analyst Michael van de Poppe has tossed out some seriously optimistic predictions. He claims there’s an 80% chance that Ethereum will break the $3,000 mark in September. That’s right, folks! Despite a current dip, the forecast looks bright, with predictions suggesting a 51% rise in the next three months. Talk about a rollercoaster! But wait, there’s more! Van de Poppe has been tracking Ethereum’s performance and believes we’re on the brink of a significant upward trend. He noted that ETH is currently trading about 6.14% below the anticipated price for next month. This dip might just be a blip on the radar before a massive rally. Remember, the last time ETH saw such a prolonged loss was just before the bear market of 2018. And we all know how that turned out! In terms of technical indicators, ETH has found support around the $2,500 mark, a level often seen before major recoveries. Plus, the stochastic RSI is currently in oversold territory, giving us more reasons to believe that a rally is imminent. If Ethereum can shake off that pesky $3,000 resistance and show some solid demand trends, we could be looking at a significant price surge. Now, let’s talk about demand trends and investor sentiment. While the technical indicators are promising, it’s not all sunshine and rainbows. The biggest altcoin has seen a decline in demand, as reflected by the falling weekly RSI. For Van de Poppe’s optimistic projection to come true, this downtrend needs to be reversed. But here’s the silver lining: US investors are starting to show renewed interest in ETH, as indicated by the positive Coinbase Premium Index. Even futures market speculators are feeling the love, with the Taker Buyer Sell Ratio showing more buying than selling. This bullish sentiment among traders is a strong indicator that Ether is set for a climb. Looking ahead, long-term projections for Ethereum are overwhelmingly positive. According to CoinCheckup, Ethereum is forecasted to rise by a staggering 120% in the next six months and a whopping 145% in the next year. So, if you’re a long-term investor, now might be the time to consider increasing your position in ETH. However, the current price levels, while backed by solid technical indicators and positive investor sentiment, still face hurdles. Improving trends in demand and network activity will be crucial for Ethereum to push above that $3,000 threshold. Investors should keep their eyes peeled for any signs that may confirm the predicted rally. Switching gears, let’s take a look at another piece from NewsBTC that highlights Ethereum’s recent price action. The price of ETH started to pull back from the $2,680 resistance and is now trading below $2,650, putting it at risk of further declines if it can’t hold above $2,550. Ethereum’s price showed signs of weakness after failing to sustain gains above the $2,680 level. It even slipped below the 23.6% Fib retracement level of its upward move. However, bulls are stepping in near the $2,620 level, hoping to keep the price afloat. If ETH can manage to break through that $2,680 resistance, we might see it climb toward the $2,720 resistance zone. But caution is key; if it fails to clear that level, further losses could push the price down to $2,550 or even lower. In summary, today’s Ethereum news is a mix of optimism and caution. With analysts predicting a potential breakout above $3,000, it’s a thrilling time for Ethereum enthusiasts. Keep an eye on those technical indicators, demand trends, and investor sentiment as we navigate through these turbulent waters. Remember, the crypto market is as unpredictable as ever, so stay informed and ready for anything! #ETH #Break #September

Will ETH Break Above $3,000 in September? – Read More »