Executive Summary: After the successful conclusion of the Merge and the removal of lock-up periods, interest in Ethereum staking is increasing rapidly. But staking comes at the cost of liquidity. Platforms that offer liquid staking derivative (LSD) tokens combine the best of both worlds – passive income from staking rewards combined with the freedom to trade and invest staked ETH on DEXs and DeFi platforms through derivative tokens.

LSD tokens come in different designs and architectures – rebasing contracts, non-rebasing tokens, single tokens, and dual-token models are the primary examples. Investors must learn about the pros and cons of each token and pick one that aligns with their long-term goals, risk tolerance, and liquidity needs.

Staking rewards from LSD tokens range from a low of 2.00% all the way up to 9.00% APY. For DeFi projects, non-rebasing, dual-token systems offer the best performance. Decentralized services are preferable to centralized platforms due to the reduced risk of network attack vulnerabilities.

What are Liquid Staking Derivatives (LSDs)?

Explain Like I’m 5: Liquid staking derivatives are like borrowing a toy that looks and feels just like your favorite toy, so you can play with it while keeping your original toy safe. You can give the borrowed toy back when you’re done and get your original toy back. It’s a way to use your locked-up cryptocurrency without actually unlocking it.

Liquid staking derivatives are an interesting new breed of crypto tokens that arose in late 2020. Like the derivative instruments in traditional finance, LSDs are financial instruments that derive their value from an underlying asset – in this instance, staked tokens in Proof-of-Stake (PoS) blockchains like Ethereum.

LSDs are the native token found on liquid staking platforms. Rocket Pool, LIDO, and StakeWise are popular examples of liquid staking service providers. When you stake your PoS tokens on these platforms, you receive an equal amount of a native LSD token in exchange. (Stake your ETH in Coinbase, get cbETH in return.)

The derivative tokens are minted on-demand in a 1:1 ratio when you deposit your tokens into the platform. And they are destroyed as soon as you withdraw your staked tokens. The LSD tokens can then generate additional yield through methods like yield farming.

Any income you generate through these methods is in addition to your staking income. If you need immediate liquidity, you can trade these tokens on derivative exchanges or use them as collateral for DeFi loans.

LSD tokens are similar to other crypto tokens since they are fully transferable and fractional. They hold a value that is similar to the underlying token. Their main purpose is to overcome the limitations associated with regular staking.

Why Invest in Liquid Staking Derivatives?

By January 2023, over 16 million ETH was locked away in staking. Liquid staking pools like Lido and Rocket Pool accounted for 42.7% of the total, worth around $10.7 billion. The success of these platforms indicates the massive demand for ETH staking despite the long lock-up period.

Although the Shanghai-Cappella upgrade in April 2023 removed the withdrawal restrictions, it has not resulted in a sustained exodus of staked ETH from validator pools. Instead, deposits exceeded withdrawals barely a month after the upgrade, indicating renewed interest in Ethereum staking.

And it is not hard to see why. To date, Ethereum staking has yielded rewards worth 1 million ETH. In the absence of mandatory lock-ups and the freedom to withdraw, the validators are likely to increase. When that happens, the average yield (APR) from staking will decrease further, especially for staking pools.

Besides, even after the Shapella upgrade, investors seeking appreciable staking returns will still have to lock their tokens away for sustained periods of up to a year or more. This, combined with the specter of lower staking rewards, makes liquid staking derivatives even more attractive for anyone who cannot afford to run their own validator nodes.

Best Staking Derivative Rates

Rocket Pool rETH

Rocket Pool rETH

Minimum Stake: 0.01 ETH

Total Value Locked (TVL): $1.17 billion

Market Share: 7.16%

Rocket Pool is one of the oldest Ethereum staking projects. The project was launched in 2016 when the Ethereum community was still debating the blockchain’s transition to the Proof-of-Stake model.

Although it has been overtaken by others like Lido and the newer Coinbase liquid staking protocol, Rocket Pool is still the third-largest liquid staking project for ETH. It retains a loyal following among crypto enthusiasts due to its heavy focus on decentralization.

The governance token of the project is RPL. The LSD token you get in exchange for staking ETH is called rETH. Anyone with 16 ETH and 1.6 ETH worth of RPL can create a Rocket Pool ETH staking node.

The remaining 16 ETH is collected from other ETH holders seeking to participate in liquid staking through permissionless staking. The minimum stake required is quite low at just 0.01 ETH or around $20 at current exchange rates.

The node operators receive a fee ranging from 5 to 20% of the staking rewards for their effort. Rocket Pool offers relatively modest yields of around 5.17%. The protocol earns income solely through RPL token emissions.

As it is significantly less centralized than Lido, with over 2000 validators compared to the latter’s 21, Rocket Pool poses minimal risk to the Ethereum blockchain. Unlike Lido’s stETH, Rocket Pool’s rETH is not a rebasing token.

The value of rETH constantly appreciates over time to reflect your staking rewards. In addition, non-rebasing tokens are easier to deploy in DeFi projects. These are some of the main reasons Rocket Pool maintains its popularity among safety-conscious stakers.

StakeWise sETH2

StakeWise sETH2

Minimum Stake: 1 wei

Total Value Locked (TVL): $163.94 million

Market Share: 1.00%

StakeWise is one of the many liquid staking protocols that appeared on the market after the launching of the Beacon Chain for the Ethereum Merge in December 2020. The LSD token awarded to ETH depositors on the staking service is called sETH2.

Apart from sETH2, the protocol also has a dedicated token for staking rewards called rETH2, which should not be confused with the rETH of Rocket Pool. Stakewise LSD token holders will start receiving rETH2 rewards within 24 hours of depositing their ETH.

StakeWise uses a decentralized system that anyone can apply to become node operators. But qualification is not guaranteed since there is a rigorous vetting process, and applicants have to garner the approval of the protocol DAO members.

For the ordinary ETH stakers, the main appeal of StakeWise sETH2 lies in its simplicity and promise of fast rewards. The service accepts minimum stakes starting at the lowest possible fraction of ETH, or 1 wei.

The dual-token system also helps the protocol avoid the common pitfalls associated with rebasing tokens. The APY reward potential is also among the highest, making StakeWise an attractive choice for stakers who want a smaller, more decentralized, and DeFi-friendly alternative to Lido.

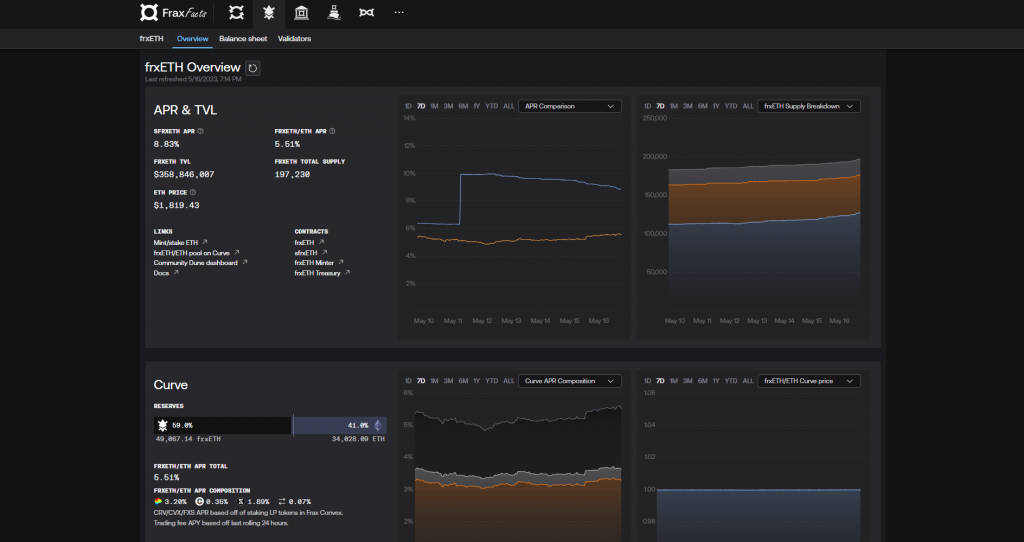

Frax Ether sfrxETH

Frax Ether sfrxETH

Minimum Stake: 1 wei

Total Value Locked (TVL): $356.03 million

Market Share: 2.17%

Frax Finance is the issuing authority of the staked Frax Ether token. Additionally, they are the issuers of the FRAX stablecoin, the first fractional reserve stablecoin pegged to the US Dollar. It is also one of the newer entries to the market, with a soft community launch in October 2022 and an official launch in January 2023.

The liquid staking service at Frax Ether follows the same basic principle as StakeWise, with separate tokens for liquidity (frxETH) and staking rewards (sfrxETH). To participate, ETH holders can deposit their tokens into the Frax ETH Minter smart contract.

Depositors receive frxETH in a 1:1 ratio. You can trade or participate in other DeFi activities using the frxETH token on the Curve platform. To access the staking rewards, you must convert the frxETH into sfrxETH tokens.

Despite its late launch, Frax Ether has attracted over $350 million in TVL with a 40% increase in staking within a few months of launch. It currently sits above older, more mature liquid staking services like StakeWise. It also boasts the highest returns of all LSD tokens, with APY approaching 9.10%.

The main risks associated with Frax are related to its algorithmic stablecoin in light of the recent collapse of Luna/Terra. But to counter that, Frax Finance has collateralized the stablecoin up to 90% using USDC and maintains deep liquidity on the Curve platform.

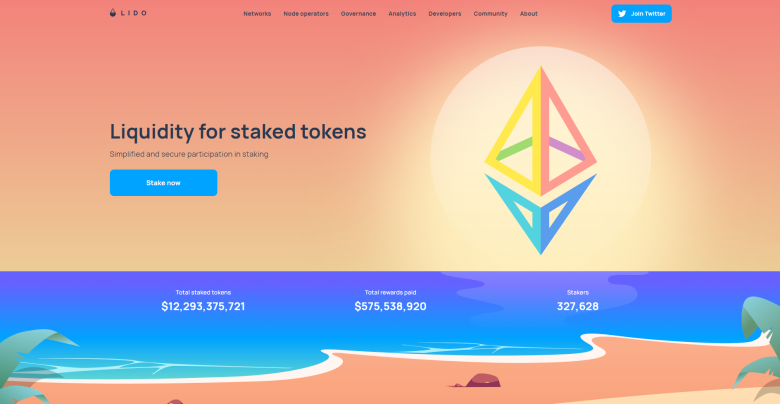

Lido stETH

Lido stETH

Minimum Stake: 1 wei

Total Value Locked (TVL): $12.22 billion

Market Share: 74.52%

With a market share that has touched 90% in the past, Lido is the dominant player in liquid staking by a large margin. It was the first mover in the liquid staking business after the beginning of the Ethereum Merge in December 2020, an advantage it has retained in the last two years. The protocol accounts for nearly 30% of all ETH staked.

Users can stake any amount of ETH on the platform and receive the stETH token in exchange at a rate of 1:1. Unlike other LSD tokens on this page, stETH is a standalone token used for liquidity and staking rewards.

The tokens are minted when a user deposits ETH on Lido. And they are burned away when the user withdraws the ETH at a later date. stETH is a rebasing token – its supply is automated through a smart contract to maintain price stability.

The quantity of stETH in supply may change daily at 12PM UTC if there are any changes in ETH2 deposits or ETH rewards. While price stability and decentralization are obvious advantages of rebasing, they also have some notable flaws.

Many DeFi apps are simply incompatible with rebasing tokens, potentially minimizing the number of available projects for stETH holders. In extreme market volatility, the rebasing function can also backfire, contributing to price instability instead of preventing it.

Lido is also a victim of its own success. The entity’s gigantic market share is a concern as it can lead to centralization and increase the risk of network attacks. Efforts are underway to minimize this risk and reduce the centralization of the protocol.

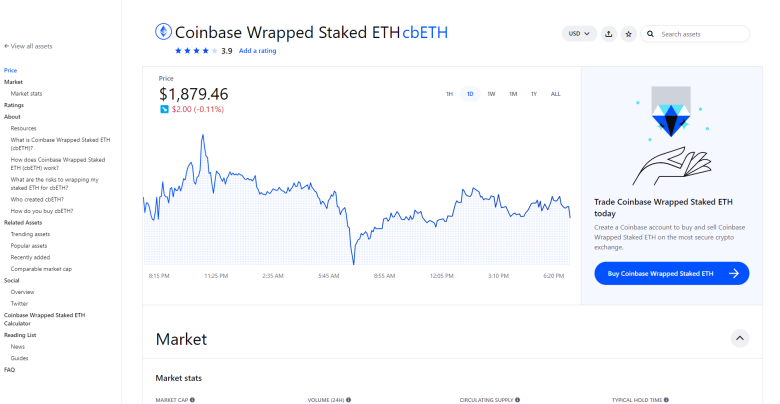

Coinbase Wrapped cbETH

Coinbase Wrapped cbETH

Minimum Stake: 1 wei

Total Value Locked (TVL): $2.14 billion

Market Share: 12.58%

Coinbase is a major centralized cryptocurrency exchange based in the United States. The platform launched its liquid staking services in August 2022. With the inherent advantage of its large user base, Coinbase has quickly become the second-largest liquid staking protocol with over $2 billion TVL within 12 months.

The LSD utility token on the platform is called the Coinbase Wrapped Staked ETH, or just cbETH for short. It is an ERC-20 token generated in exchange for your staked ETH in a 1:1 ratio. But since it is a wrapped token, the prices of cbETH will tend to be lower than the market price of ETH, and the 1:1 value is not pegged.

You can buy and stake ETH using the Coinbase app. The wrapped cbETH can be traded on the exchange or moved on-chain and be used in various other DeFi projects on platforms like Curve Finance and Aave. Instead of staking ETH, you can also buy the wrapped token directly.

Due to the platform expenses and other fees involved, cbETH staking rewards tend to be lower than other decentralized protocols in the liquid staking scene. If you already use Coinbase actively for trading and staking ETH, cbETH could be a good option for the sheer sake of familiarity and ease of access.

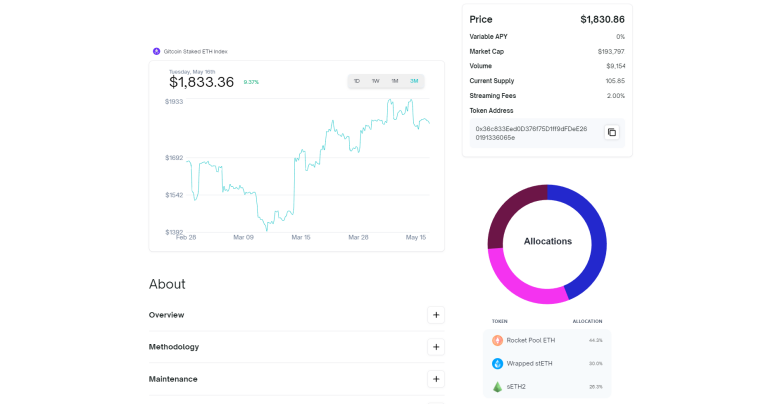

Gitcoin Staked Ethereum Index

Gitcoin Staked Ethereum Index

Minimum Stake: 1.01 ETH

Total Value Locked (TVL): N/A

Market Share: N/A

Investing in a single LSD token can expose you to some degree of risk from volatility. Spreading your ETH across multiple liquid staking services can mitigate this to some extent, but it is not very convenient.

Investing in an index token that gives you exposure to the top LSD tokens in the market is a more convenient and safe alternative. One such option in this space comes from a DAO called Index. It was launched by Set Labs in October 2020 with the aim of decentralizing the blockchain finance ecosystem.

Index has launched several index tokens that focus on major LSD tokens from Lido, Rocket Pool, and StakeWise. One such token with a public service motive is the Gitcoin Staked Ethereum Index. The LSD token here is called gtcETH.

Buying gtcETH gives you exposure to the major LSD tokens while accruing staking rewards. Index collects a 2.00% streaming fee on the platform. Out of this, 1.75% is paid out to Gitcoin, an open-source, decentralized platform that focuses on funding public goods projects in the Ethereum ecosystem.

Investing in gtcETH is like indirectly subscribing to Gitcoin – you are basically contributing funds to their projects while simultaneously earning a portion of staking rewards. Due to that streaming fee, rewards on gtcETH are among the lowest of all liquid staking services. It is a worthy option for ETH stakers who want to diversify while contributing to Gitcoin initiatives.

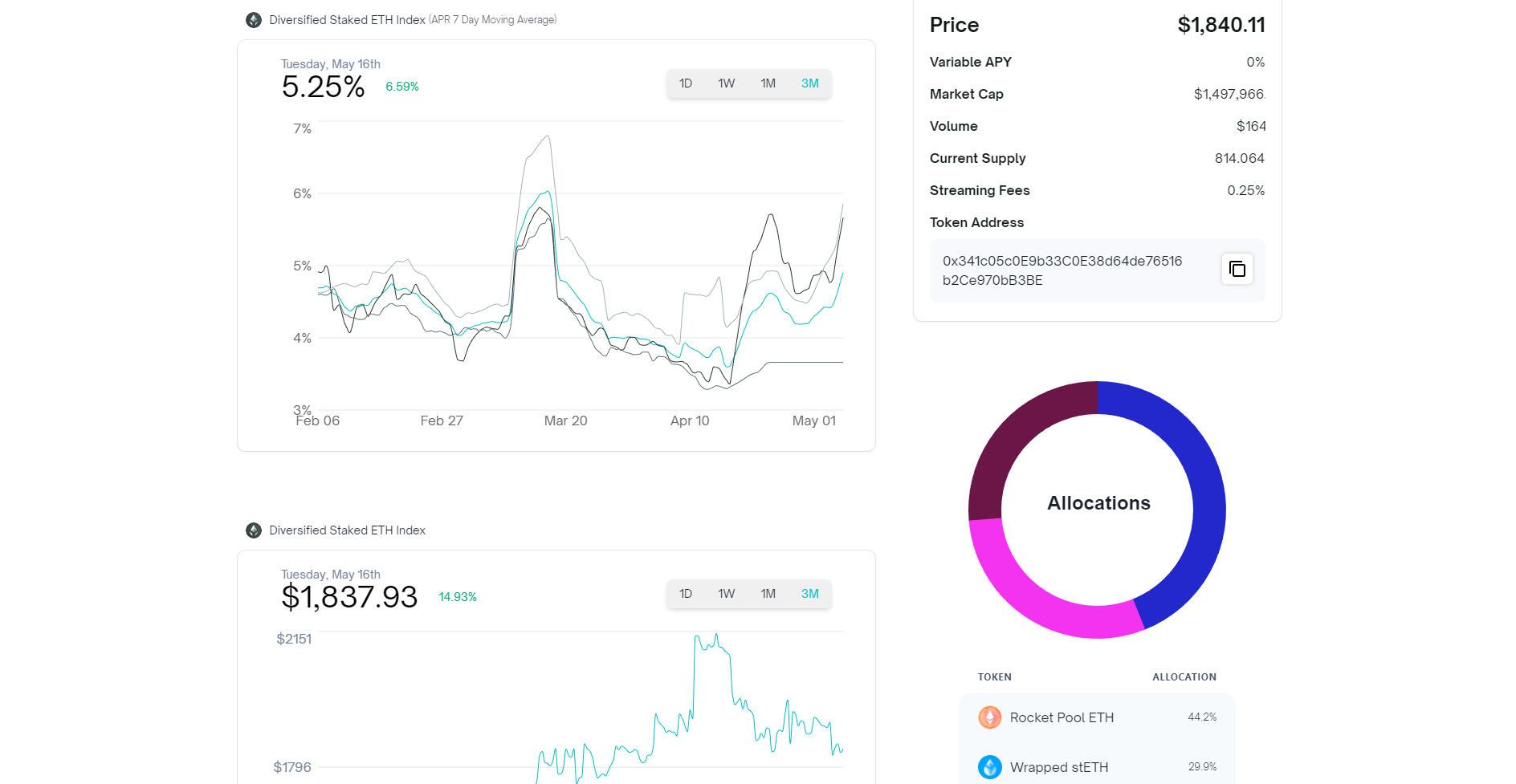

Diversified Staked Ethereum Index

Diversified Staked Ethereum Index

Minimum Stake: 1.01 ETH

Total Value Locked (TVL): N/A

Market Share: N/A

This is the second index token from Index DAO. Like the Gitcoin Index, the Diversified Index tracks the major liquid staking tokens like Lido’s stETH and Rocket Pool’s rETH. But unlike the other project, this one promises higher rewards.

Streaming fees exist, but here, you are just paying the basic 0.25% fee to the Index Coop. The LSD token is called dsETH, and you can buy it on most decentralized exchanges. Another option is to get it by redeeming ETH on the Indeed Coop App through a process dubbed Flash Minting.

Both gtcETH and dsETH are virtually identical, save for the additional funding to Gitcoin in the former. They both allow holders to earn passive income while spreading the risk across multiple LSD tokens in the marketplace.

In the process, you can also contribute to the overall decentralization of the Ethereum staking ecosystem. dsETH rewards are comparable to other major LSD tokens like Rocket Pool or Coinbase, at an average of 5% APY.

Investor Takeaway

The liquid staking derivative space is a rapidly evolving market. Investors already have access to a plethora of LSD tokens, each with unique advantages and weaknesses.

For investors who want the token with the most market share, Lido is the undisputed champion. But concerns exist regarding its potential threat to the long-term decentralization of the Ethereum network.

If high returns are a priority, Frax and StakeWise are the optimal choices with the highest APY among leading tokens.

For investors concerned about over-centralization in the Ethereum ecosystem, there is probably no better option than Rocket Pool.

If you prioritize diversification above all else and want to minimize risk as much as possible, consider investing in an index token like dsETH on the Index Coop app.

And if you are a Coinbase regular, the on-chain cbETH is probably the safest, easiest option for investors who don’t mind the centralized architecture.

Don’t forget to Subscribe to Bitcoin Market Journal to keep receiving helpful crypto investing tips, directly to your inbox.

#Staking #Rates #Liquid #Staking #Derivatives